Fiscal Year Calendar 2025: A Comprehensive Overview

Related Articles: Fiscal Year Calendar 2025: A Comprehensive Overview

- Red Rocks Concerts 2025 Calendar: A Guide To The Ultimate Concert Experience

- Printable Small Calendar 2025: A Convenient And Customizable Companion

- 2025 Vector Calendar: A Comprehensive Guide To Design And Customization

- South Australia 2025 Calendar: A Comprehensive Guide To Public Holidays And Observances

- The Timeless Tool: A Comprehensive Exploration Of Calendars

Introduction

With great pleasure, we will explore the intriguing topic related to Fiscal Year Calendar 2025: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fiscal Year Calendar 2025: A Comprehensive Overview

Fiscal Year Calendar 2025: A Comprehensive Overview

Introduction

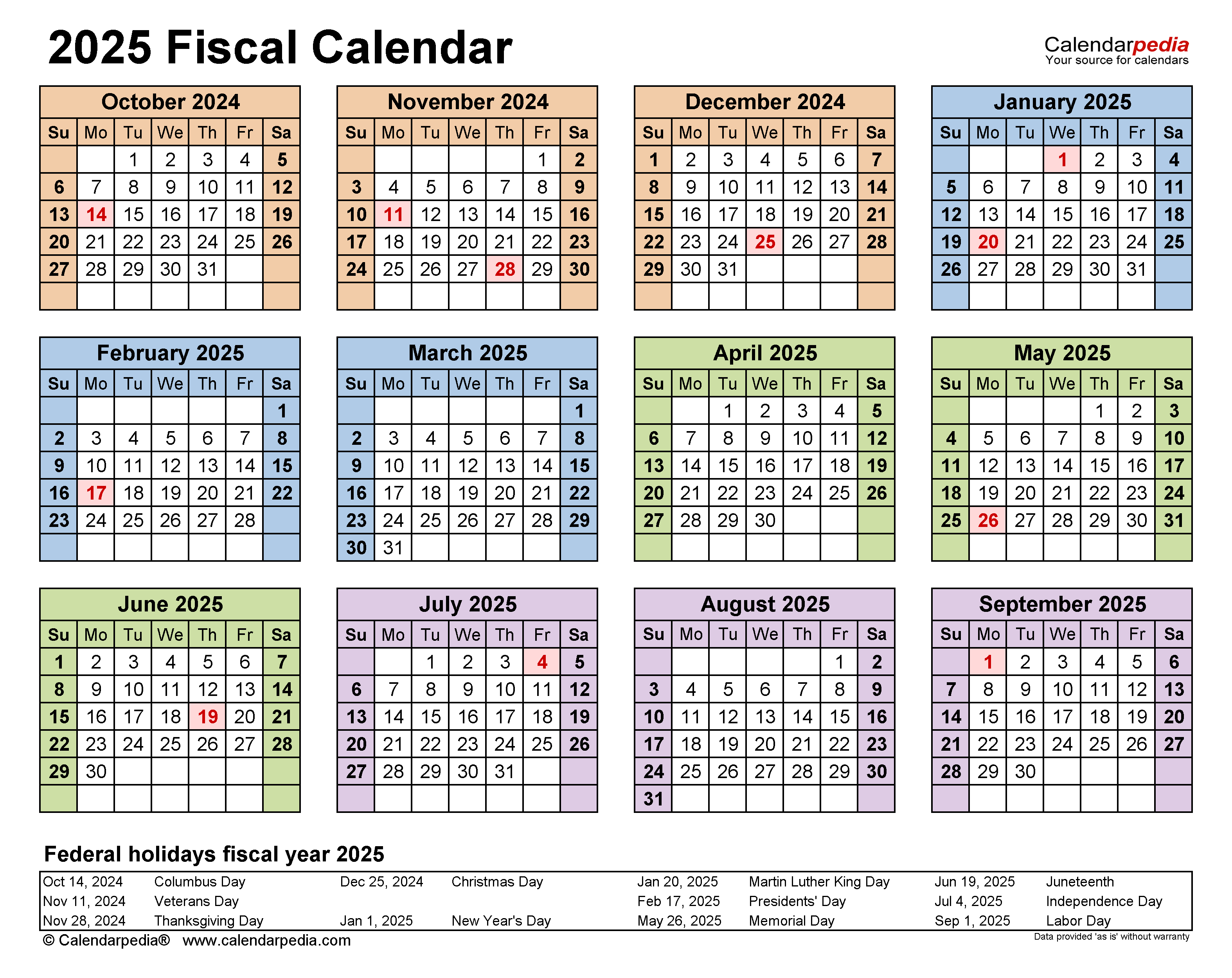

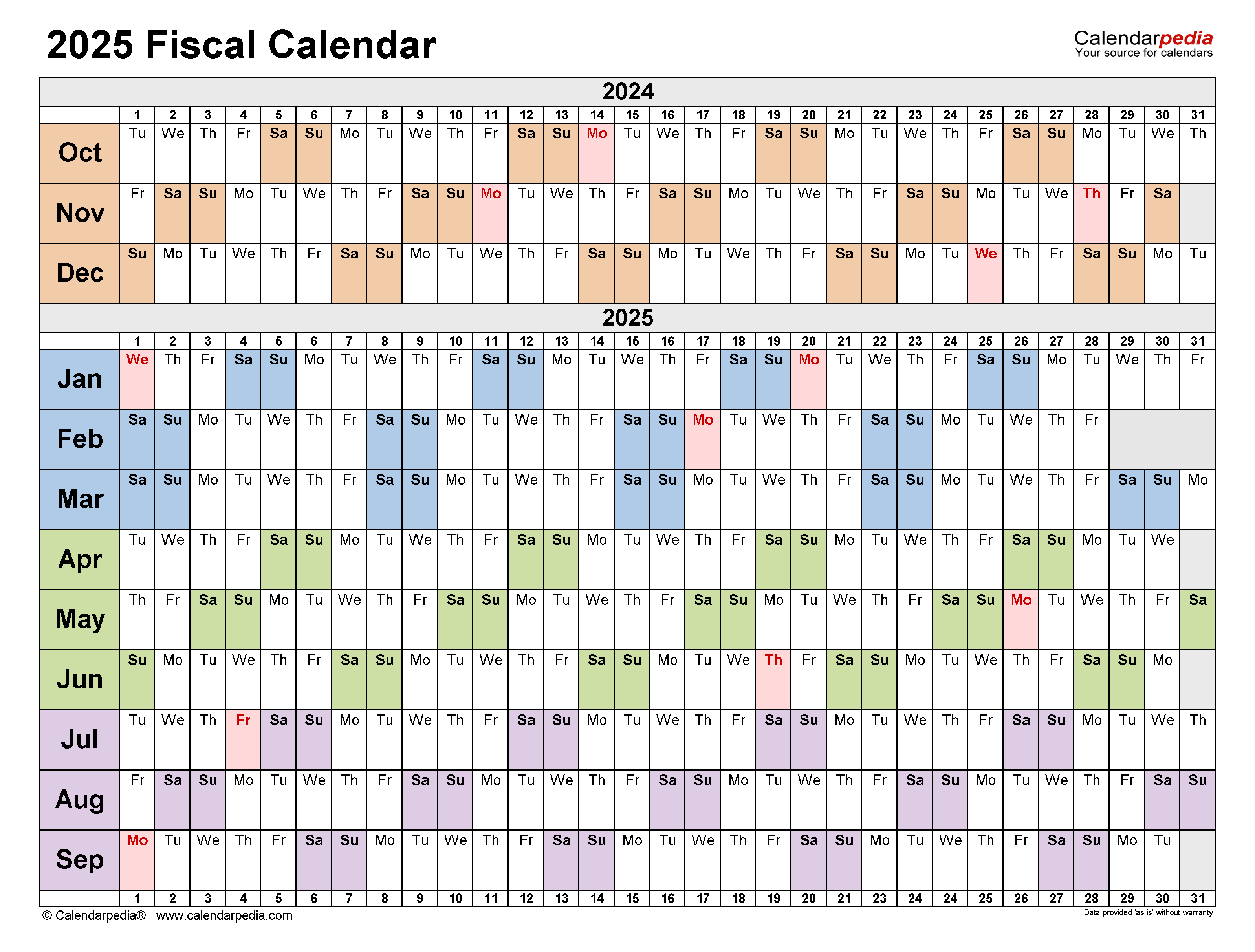

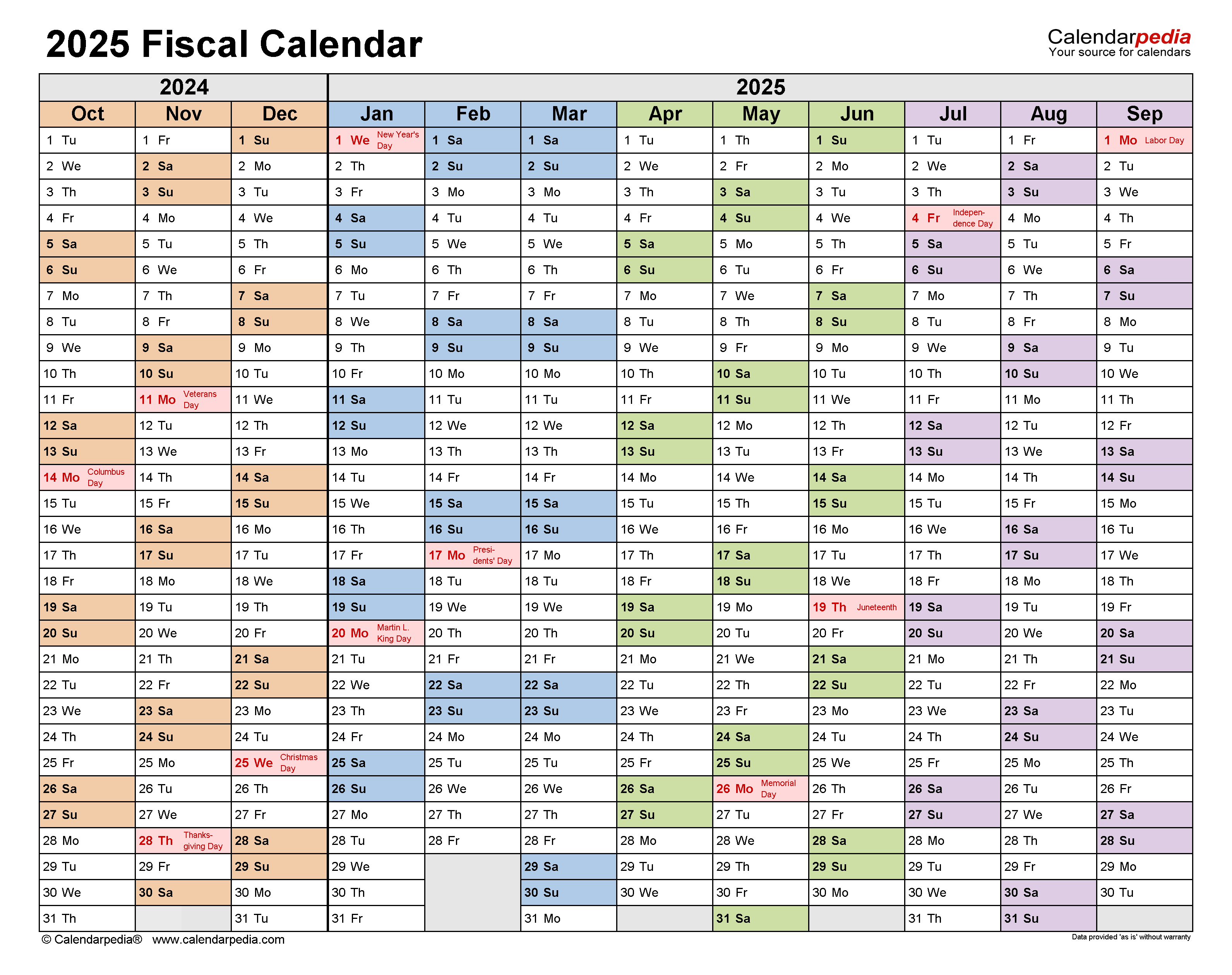

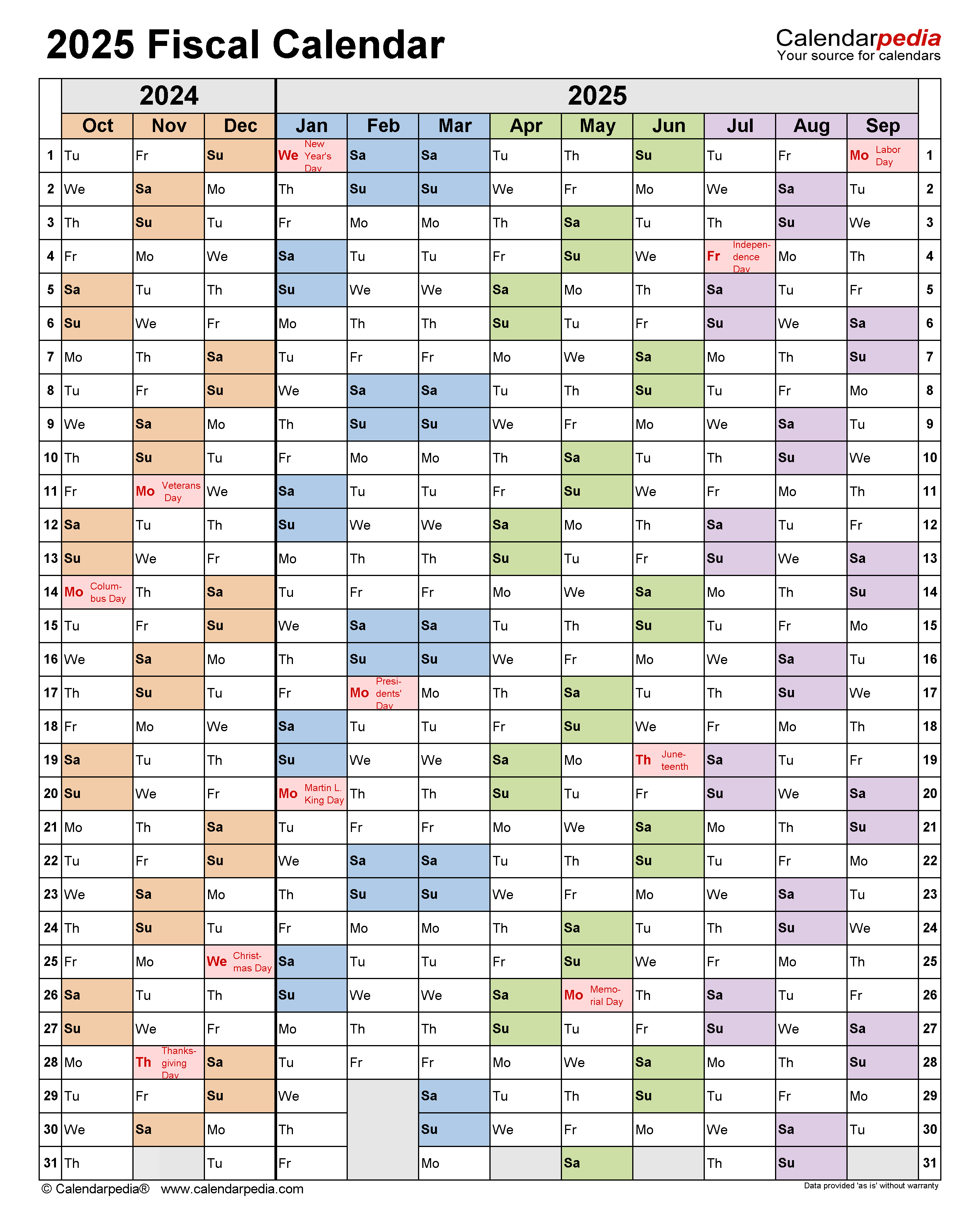

The fiscal year (FY) calendar is a crucial tool for businesses and organizations to plan, budget, and track their financial performance. It establishes a consistent time frame for financial reporting and analysis, enabling stakeholders to make informed decisions. This article provides a comprehensive overview of the fiscal year calendar for 2025, including its start and end dates, quarter and month divisions, and key financial reporting deadlines.

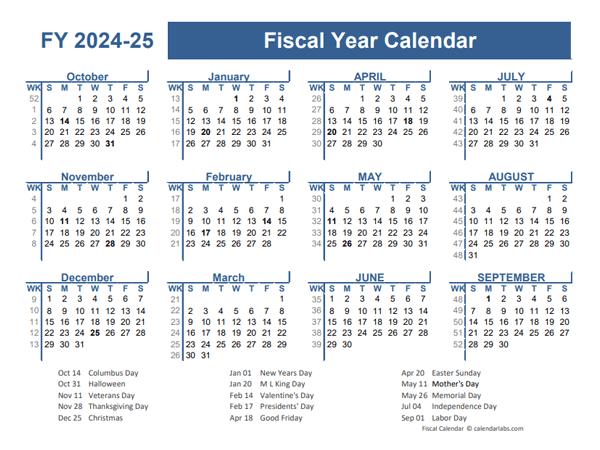

Start and End Dates

The fiscal year 2025 begins on January 1, 2025, and ends on December 31, 2025. This aligns with the calendar year, which is the most common fiscal year period used by businesses worldwide.

Quarters and Months

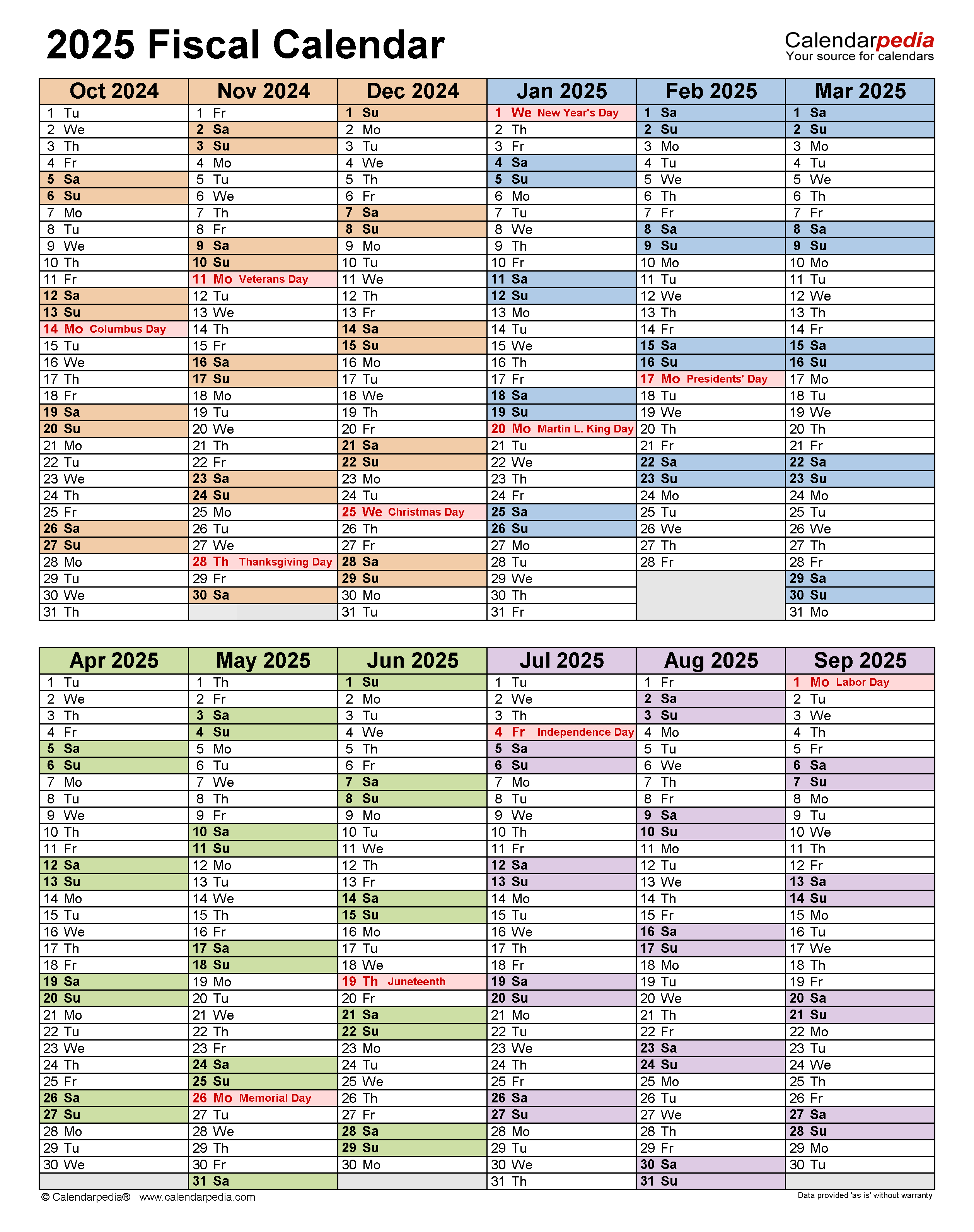

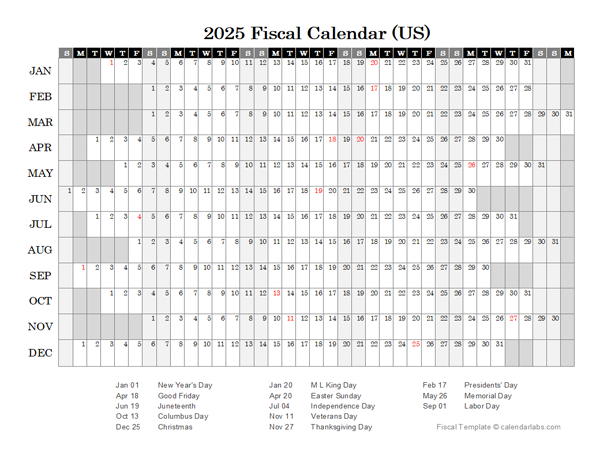

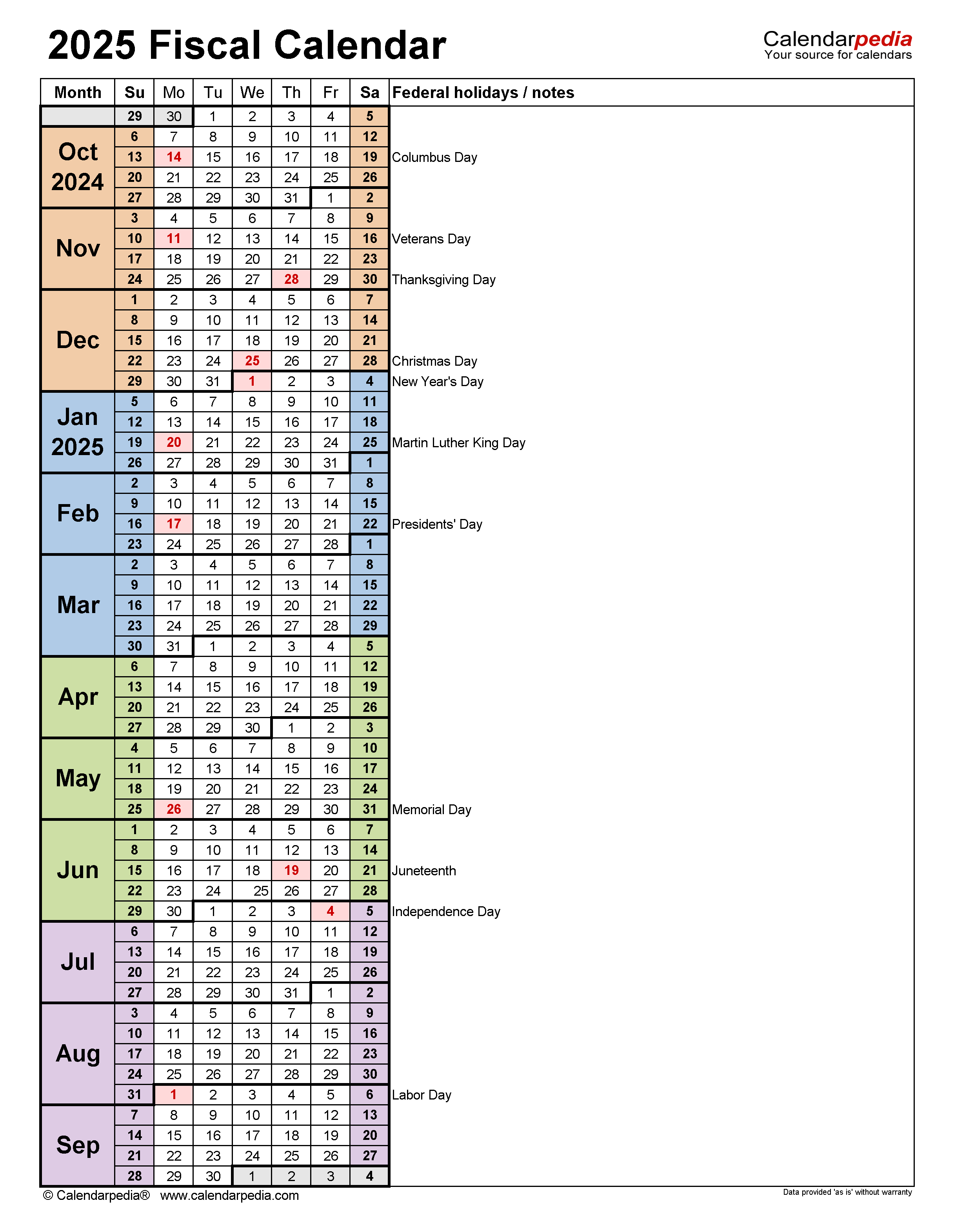

The fiscal year is divided into four quarters, each consisting of three months:

- Quarter 1 (Q1): January 1 – March 31

- Quarter 2 (Q2): April 1 – June 30

- Quarter 3 (Q3): July 1 – September 30

- Quarter 4 (Q4): October 1 – December 31

The fiscal year is also divided into 12 months:

- January

- February

- March

- April

- May

- June

- July

- August

- September

- October

- November

- December

Key Financial Reporting Deadlines

Various financial reporting deadlines fall within the fiscal year calendar, including:

- Form 10-Q (Quarterly Report): Due 45 days after the end of each fiscal quarter (April 15, July 15, October 15, January 15)

- Form 10-K (Annual Report): Due 90 days after the end of the fiscal year (March 31)

- Form 8-K (Current Report): Filed within 4 business days of a material event

Benefits of a Fiscal Year Calendar

Adopting a fiscal year calendar offers several advantages:

- Consistency: It provides a consistent time frame for financial reporting, enabling year-over-year comparisons and trend analysis.

- Alignment with Business Cycle: Businesses can align their fiscal year with their natural business cycle, which may differ from the calendar year.

- Tax Planning: Some businesses may choose a fiscal year that allows them to optimize their tax strategies.

- Flexibility: Unlike the calendar year, businesses can select a fiscal year that best suits their operational and reporting needs.

Considerations for Choosing a Fiscal Year

When selecting a fiscal year, businesses should consider the following factors:

- Business Cycle: The fiscal year should align with the company’s peak and off-peak periods.

- Industry Norms: Some industries have established industry-wide fiscal years.

- Tax Implications: The fiscal year should minimize tax liabilities or provide other tax advantages.

- Reporting Deadlines: Businesses should ensure they can meet all relevant financial reporting deadlines.

Conclusion

The fiscal year calendar 2025 provides a structured framework for financial reporting and analysis. By understanding the start and end dates, quarter and month divisions, and key financial reporting deadlines, businesses can effectively plan and track their financial performance. Choosing a fiscal year that aligns with the business cycle and reporting needs is essential for optimal efficiency and accuracy.

Closure

Thus, we hope this article has provided valuable insights into Fiscal Year Calendar 2025: A Comprehensive Overview. We hope you find this article informative and beneficial. See you in our next article!