Fiscal Year Calendar 2025

Related Articles: Fiscal Year Calendar 2025

- 2025 Calendar Printable With Holidays In Word: A Comprehensive Guide

- April 2025 Calendar For Indonesia

- Official 2025 Calendar: A Comprehensive Guide

- July And August 2025 Calendar Planner: A Comprehensive Guide To Enhance Your Productivity And Time Management

- Six-Month Calendar 2025: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Fiscal Year Calendar 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fiscal Year Calendar 2025

Fiscal Year Calendar 2025

Introduction

A fiscal year calendar is a financial reporting framework that businesses and organizations use to track and manage their financial activities. It defines the specific period of time, usually 12 months, during which the financial performance of an organization is measured and reported. The fiscal year calendar is distinct from the calendar year, which runs from January 1st to December 31st.

Importance of a Fiscal Year Calendar

A well-defined fiscal year calendar is essential for businesses for several reasons:

- Financial Reporting: The fiscal year calendar establishes the time frame for financial reporting, including the preparation of financial statements such as the balance sheet, income statement, and cash flow statement.

- Tax Compliance: Many countries have specific tax reporting requirements that are based on the fiscal year. Adhering to the fiscal year calendar ensures compliance with these regulations.

- Budgeting and Forecasting: The fiscal year calendar provides a framework for budgeting and forecasting financial performance. It allows businesses to plan and allocate resources effectively.

- Performance Measurement: The fiscal year calendar enables businesses to track their financial performance over specific periods and compare it to previous years or industry benchmarks.

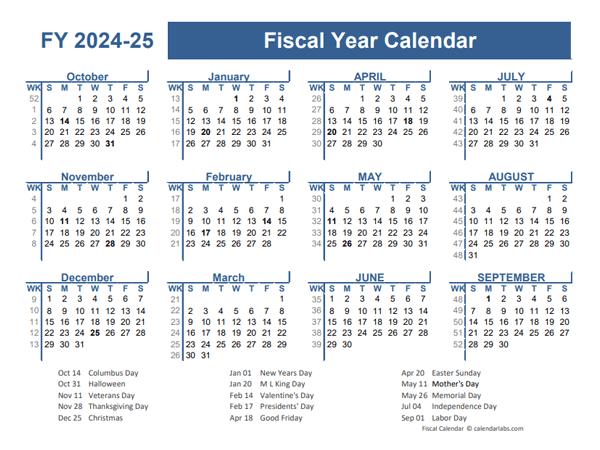

Fiscal Year Calendar 2025

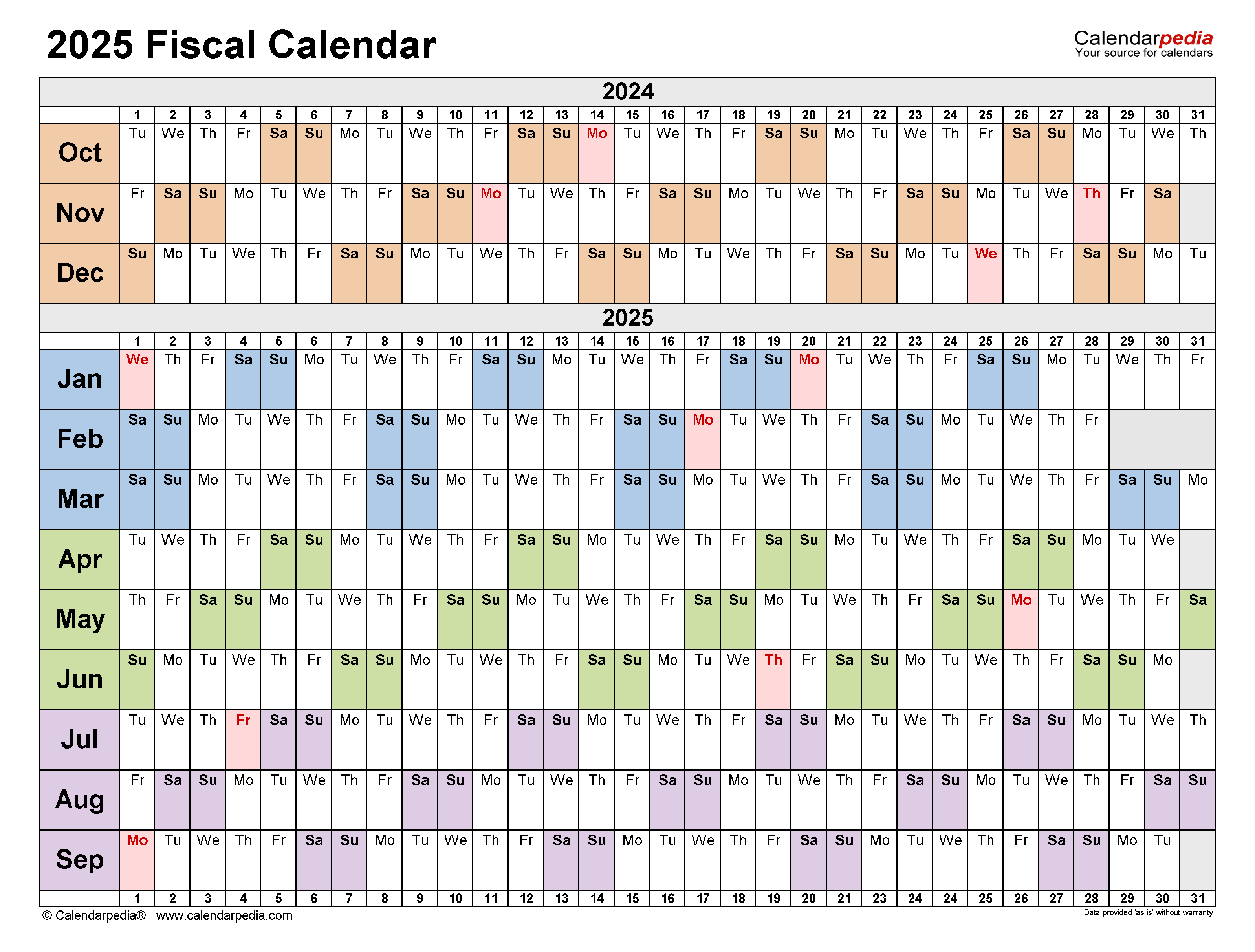

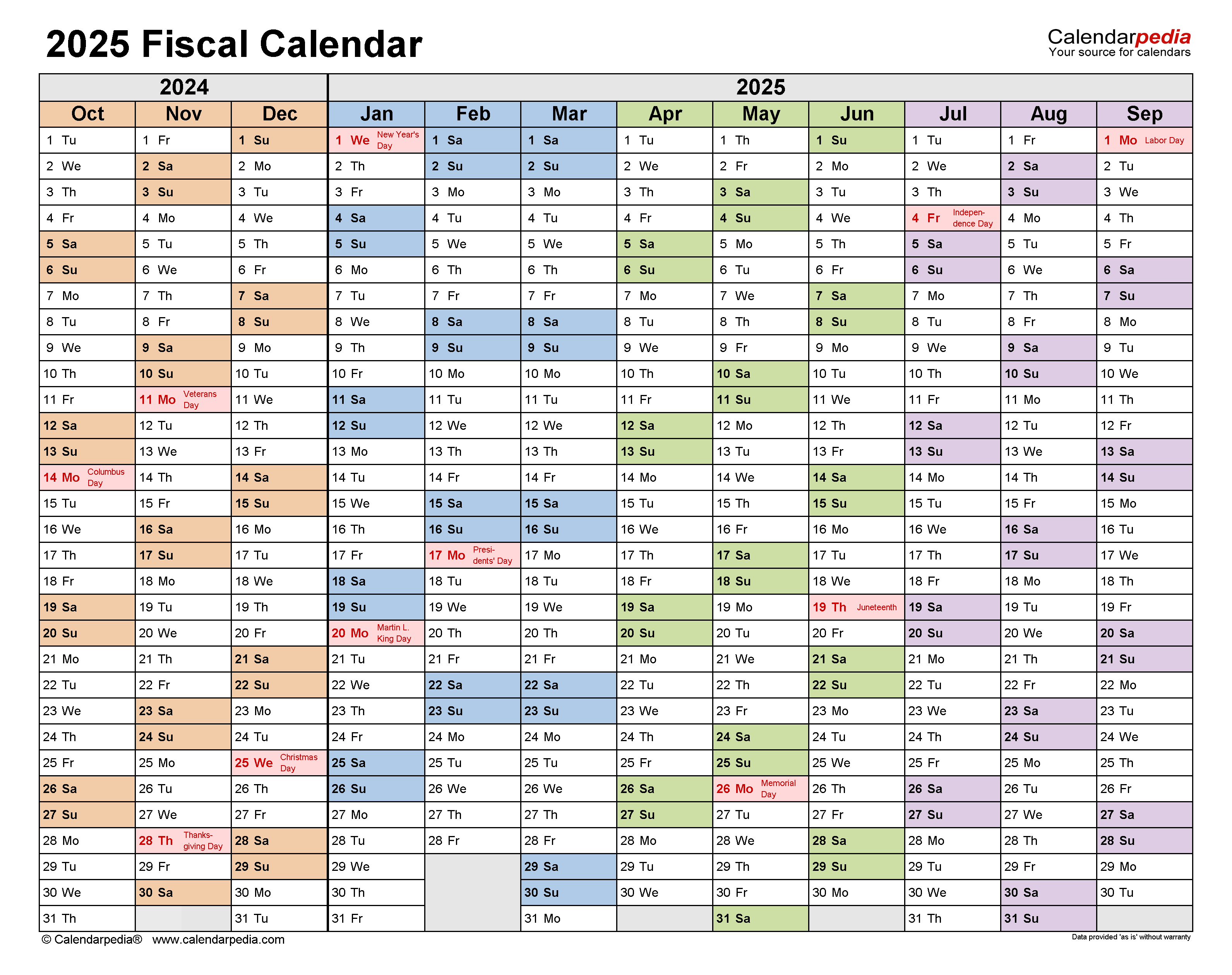

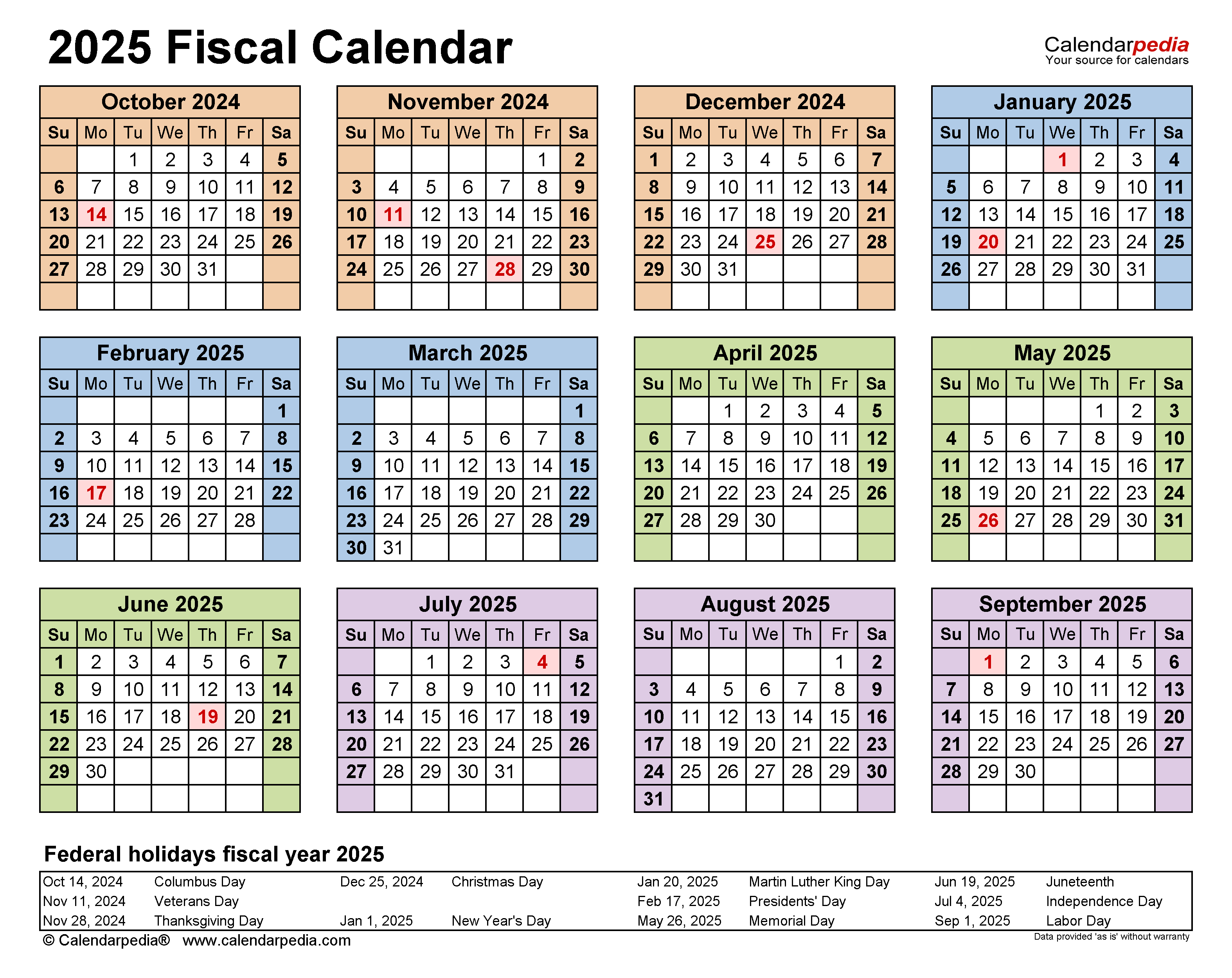

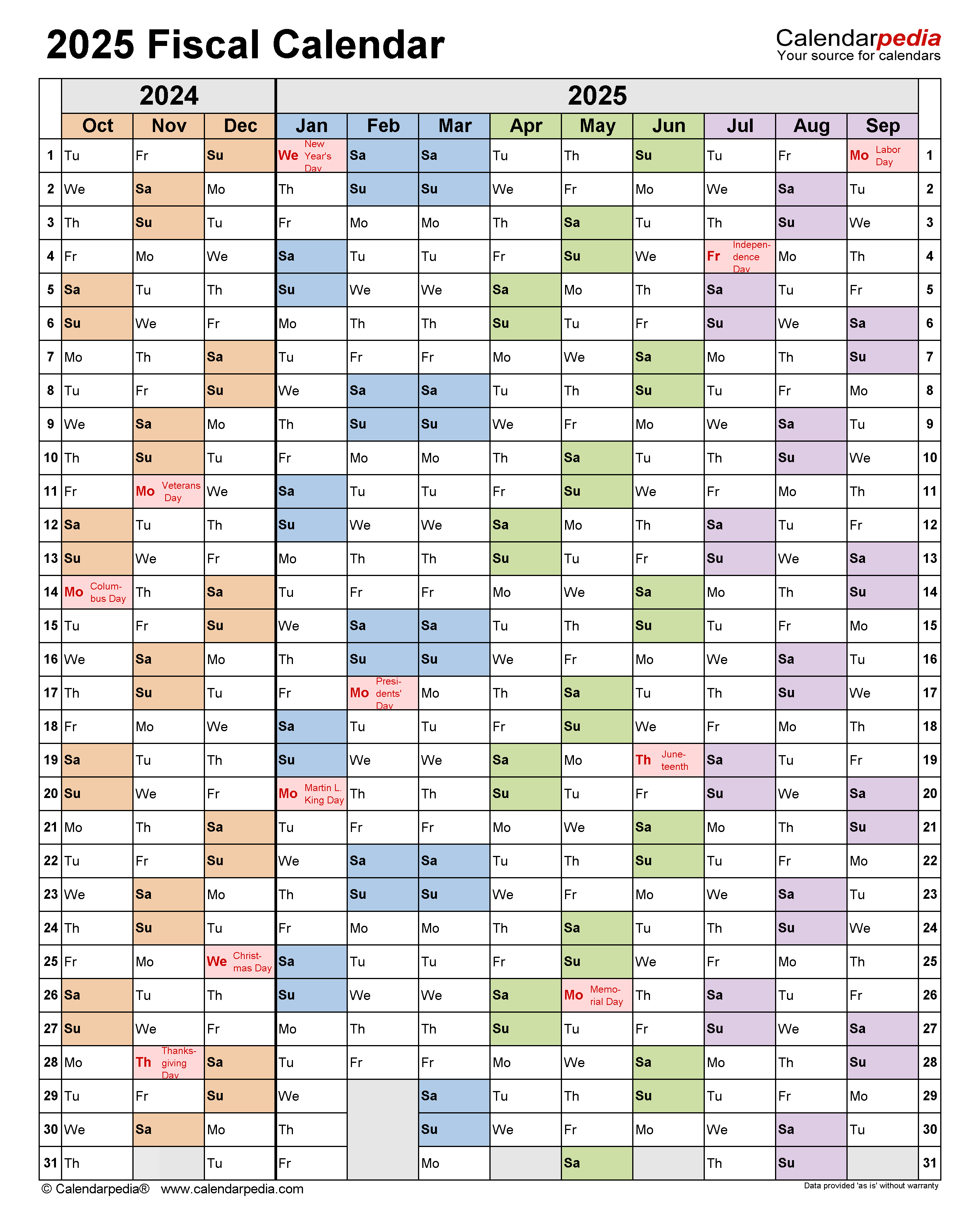

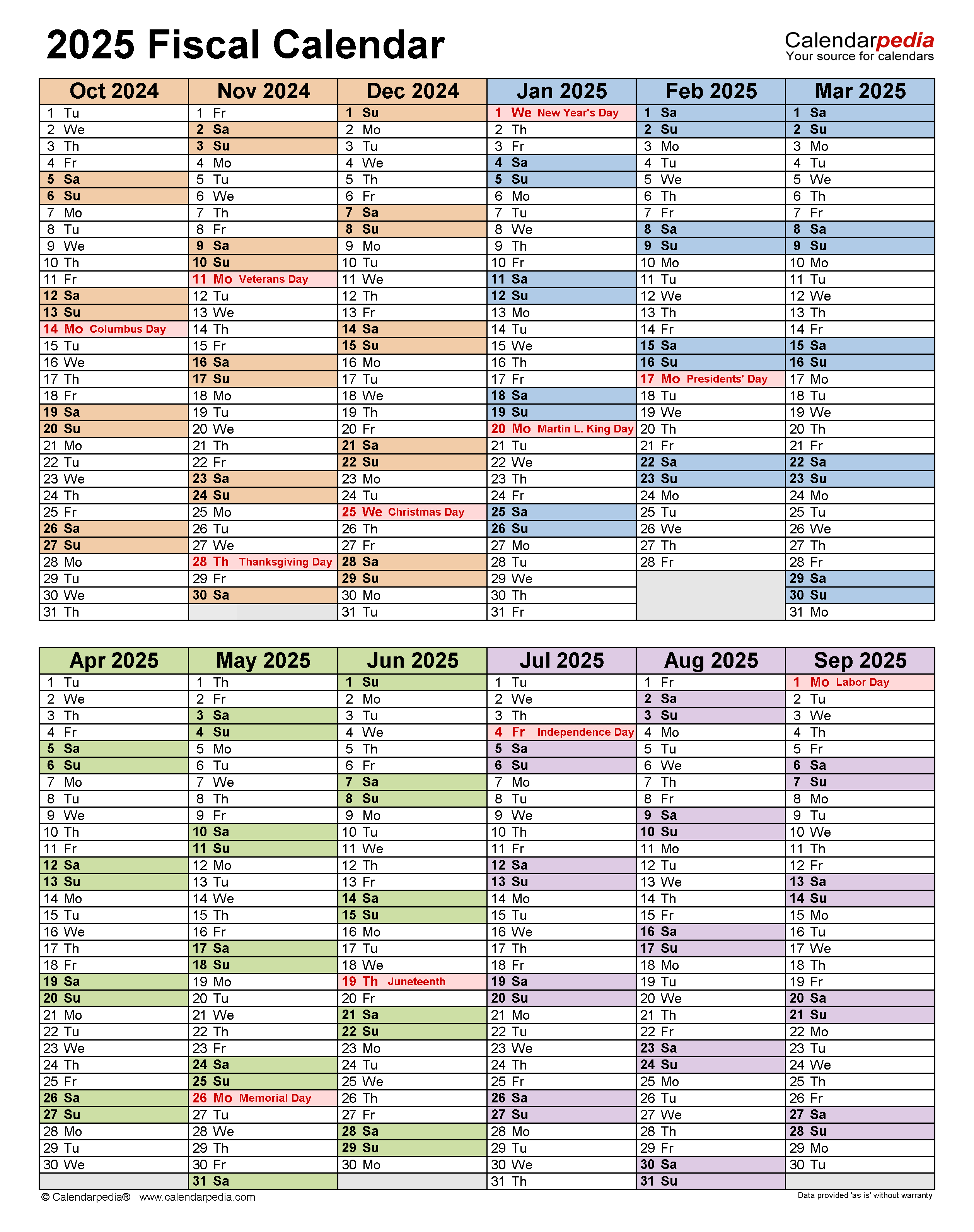

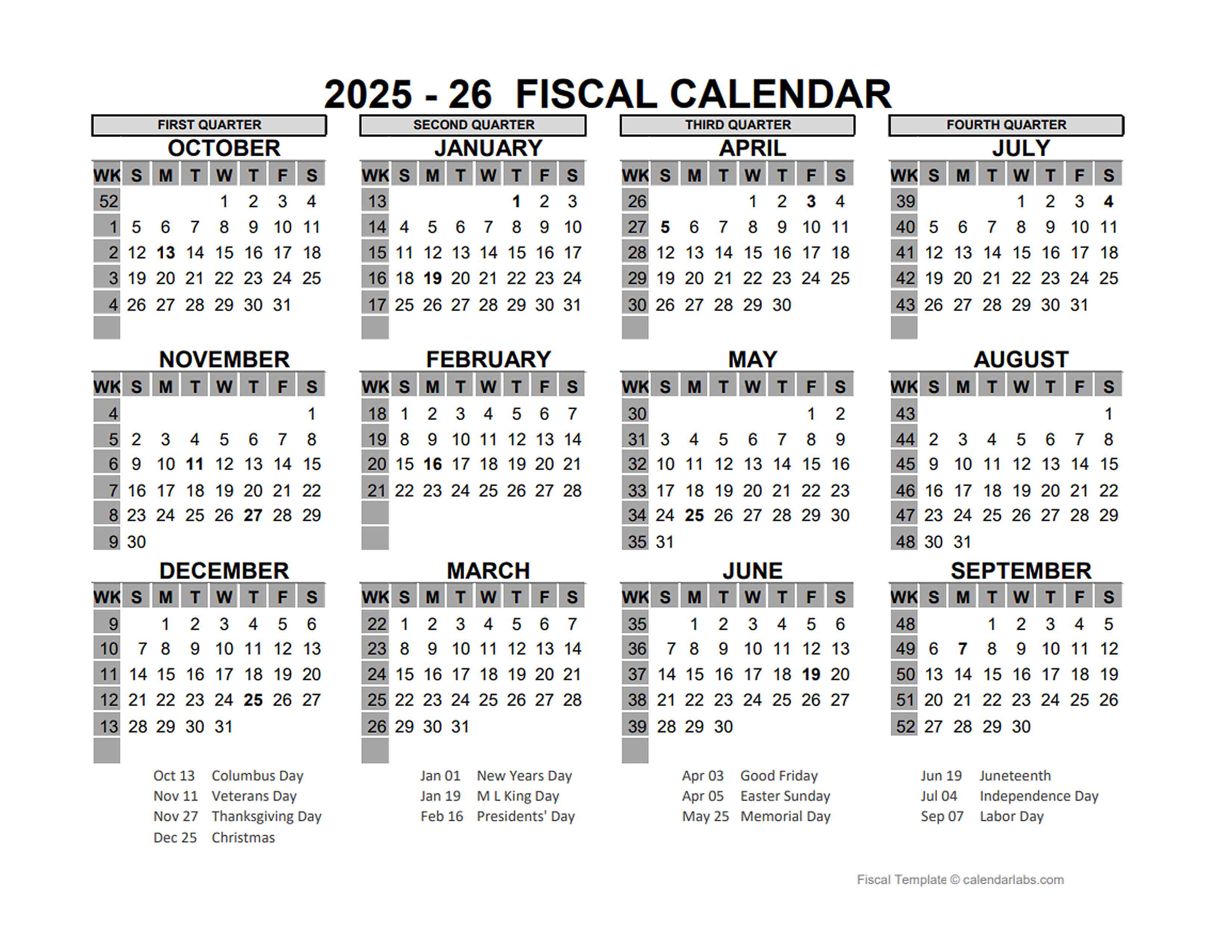

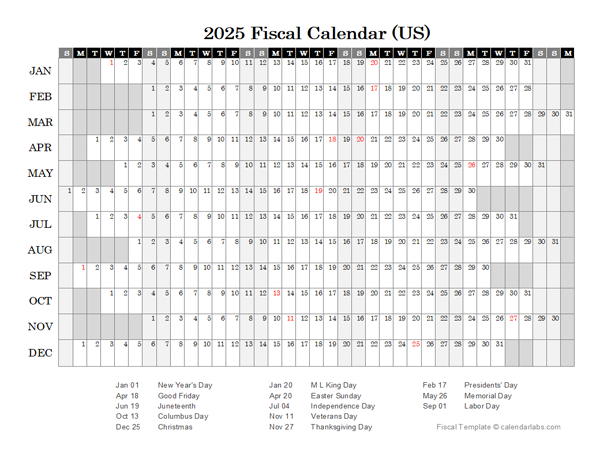

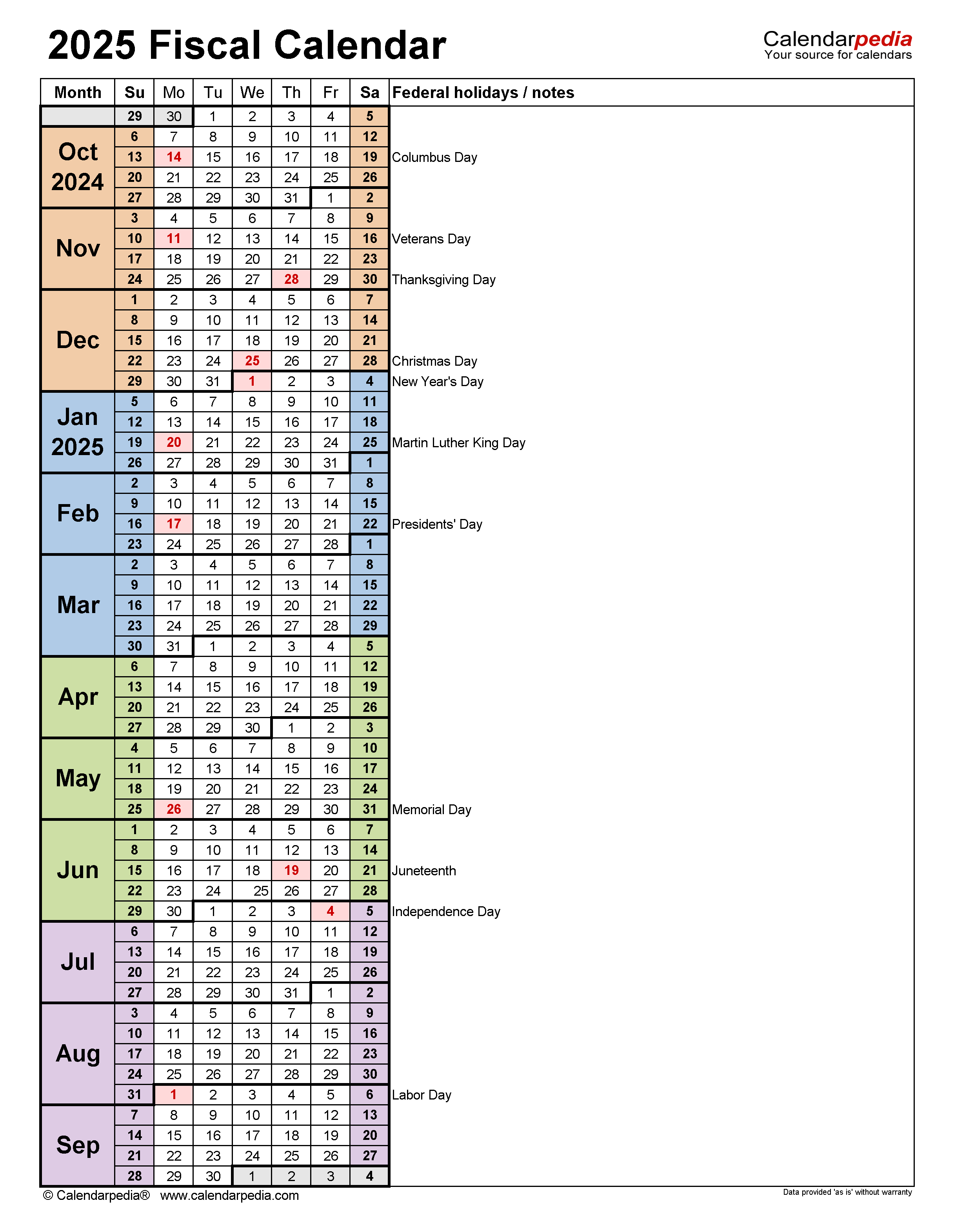

The fiscal year calendar for 2025 begins on October 1st, 2024, and ends on September 30th, 2025. This means that businesses using this fiscal year calendar will close their books and prepare financial statements for the 12-month period from October 1st, 2024, to September 30th, 2025.

Advantages of a Fiscal Year Calendar

There are several advantages to using a fiscal year calendar, including:

- Alignment with Business Cycle: Businesses can align their fiscal year with their natural business cycle. For example, a retail business may choose a fiscal year that runs from September to August to capture the peak holiday shopping season.

- Tax Optimization: Some businesses may benefit from choosing a fiscal year that aligns with their tax liabilities. This can help them optimize their tax payments and reduce their overall tax burden.

- Flexibility: Businesses have the flexibility to choose a fiscal year that best suits their needs. This allows them to avoid periods of seasonal fluctuations or other factors that could impact their financial reporting.

Disadvantages of a Fiscal Year Calendar

There are also some potential disadvantages to using a fiscal year calendar, including:

- Complexity: Maintaining a fiscal year calendar can be more complex than following the calendar year. This is especially true for businesses that operate internationally or have complex financial reporting requirements.

- Non-Standard Reporting: Financial statements prepared using a fiscal year calendar may not be comparable to those of companies that use the calendar year. This can make it more difficult for investors and other stakeholders to assess the company’s financial performance.

- Potential for Errors: There is a greater potential for errors when using a fiscal year calendar, as it involves additional calculations and adjustments to align with the calendar year for tax and reporting purposes.

Choosing a Fiscal Year Calendar

When choosing a fiscal year calendar, businesses should consider the following factors:

- Business Cycle: The natural business cycle of the organization.

- Tax Considerations: The tax implications of different fiscal year choices.

- Industry Standards: The fiscal year calendar used by similar businesses in the industry.

- Complexity: The complexity of maintaining a fiscal year calendar.

- Reporting Requirements: The financial reporting requirements of the business.

Conclusion

A fiscal year calendar is an essential tool for businesses to manage their financial activities and ensure compliance with reporting and tax regulations. By carefully considering the advantages and disadvantages, businesses can choose a fiscal year calendar that best meets their needs and helps them achieve their financial goals.

Closure

Thus, we hope this article has provided valuable insights into Fiscal Year Calendar 2025. We hope you find this article informative and beneficial. See you in our next article!